unemployment tax break refund update today

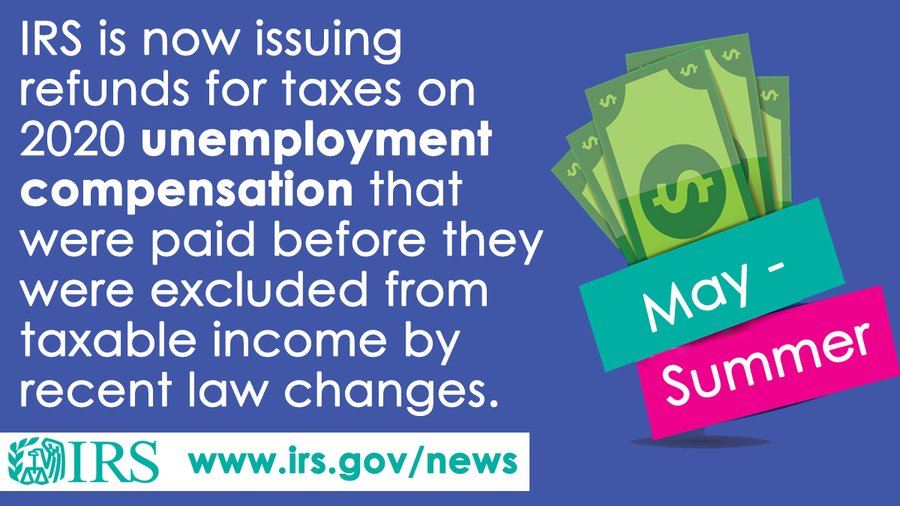

So far the IRS has identified over 16 million taxpayers who may be eligible for the adjustment. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

IRS tax refunds to start in May for 10200 unemployment tax break.

. The agency had sent more than 117 million refunds worth 144 billion as of Nov. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

Reminders and tips. If there are any errors or if you filed a claim for an earned income tax credit or the child tax credit the wait could be lengthyIf there is an issue holding up your return the resolution depends on how quickly and accurately you respond and. And this tax break only applies to 2020.

The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly or 10200 for all other eligible taxpayers. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income. Check For the Latest Updates and Resources Throughout The Tax Season.

A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

Now the good news is that last year the IRS paid tax filers interest on refunds issued after the original April 15 tax-filing deadline. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. Some will receive refunds while others will have the overpayment applied to taxes due or other debts.

Guto Harri reportedly lobbied No 10 chief of staff to stop ban on Huawei. Good news -- if you filed your 2020 taxes without claiming a tax break on your unemployment income the IRS will take care of it for you. Updated March 23 2022 A1.

Unemployment Tax Break. In the latest batch of refunds announced in November however the average was 1189. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

IRS tax deadline. Specifically the rule allows you to exclude the first 10200 of benefits up to 10200 for each spouse if filing jointly from your income on your federal return if you have an adjusted gross income of less than 150000 for all. The Internal Revenue Service IRS has started issuing tax refunds to those who received unemployment benefits in 2020 with around 15.

People who received unemployment benefits last year and filed tax. Only up to the first 10200 of unemployment compensation is not taxable for an individual. Retirement and health contributions extended to May 17 but estimated payments still due April 15.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. If both spouses lost work in 2020 a married couple filing a joint return might not have to pay federal income taxes on up to 20400 in jobless benefits.

Heres what you need to know. 22 2022 Published 742 am. However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break.

You already filed a tax return and did not claim the unemployment exclusion. The IRS usually issues tax refunds within three weeks but some taxpayers have been waiting months to receive their payments. Thankfully the IRS has a plan for addressing returns that didnt account for that change.

This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. But much depends on how much each person received in benefits. A total of 542000 refunds are involved.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in. Surprise 581 checks paid out to 524000 Americans in time for New Years Eve.

The IRS plans to send another tranche by the end of the year. However the IRS has not yet announced a date for August. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. Thats the same data.

Will I receive a 10200 refund. The legislation allows taxpayers who earned less than 150000 in adjusted. Thousands of taxpayers may still be waiting for a.

The IRS efforts to correct unemployment compensation overpayments will help most of the affected taxpayers avoid filing an amended tax return. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. By Anuradha Garg.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What You Need To Know About Unemployment Tax Refunds And When You Ll Get It

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Unemployment Tax Updates To Turbotax And H R Block

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Here S How To Track Your Unemployment Tax Refund From The Irs

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Interesting Update On The Unemployment Refund R Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time